open end mortgage vs heloc

Thats because HELOCs are considered riskier for mortgage. This is called the draw period.

Home Equity Second Mortgage Vs Home Equity Loan U S Bank

Web Since a HELOC is secured by a borrowers home they are considered low-risk products and lenders typically offer them at more attractive interest rates compared.

. Web Draw period limitations Open-end mortgages may only allow you to take additional distributions during a limited time. Web A first mortgage is the original loan that you take out to purchase your home. And so those interested in finding a buyer should get.

A home equity line of. Unlike other mortgages the HELOC functions like a credit card. You can withdraw as much as needed up to the maximum loan amount from the line of credit.

Web Open-end credit is not restricted to a specific use. This type of loan is known as an open ended loan. Web HELOC-Open-ended for flexibility.

While this loan has a. Web In particular the term open end mortgage can mean more than one thing. Consider a borrower who gets approved for an.

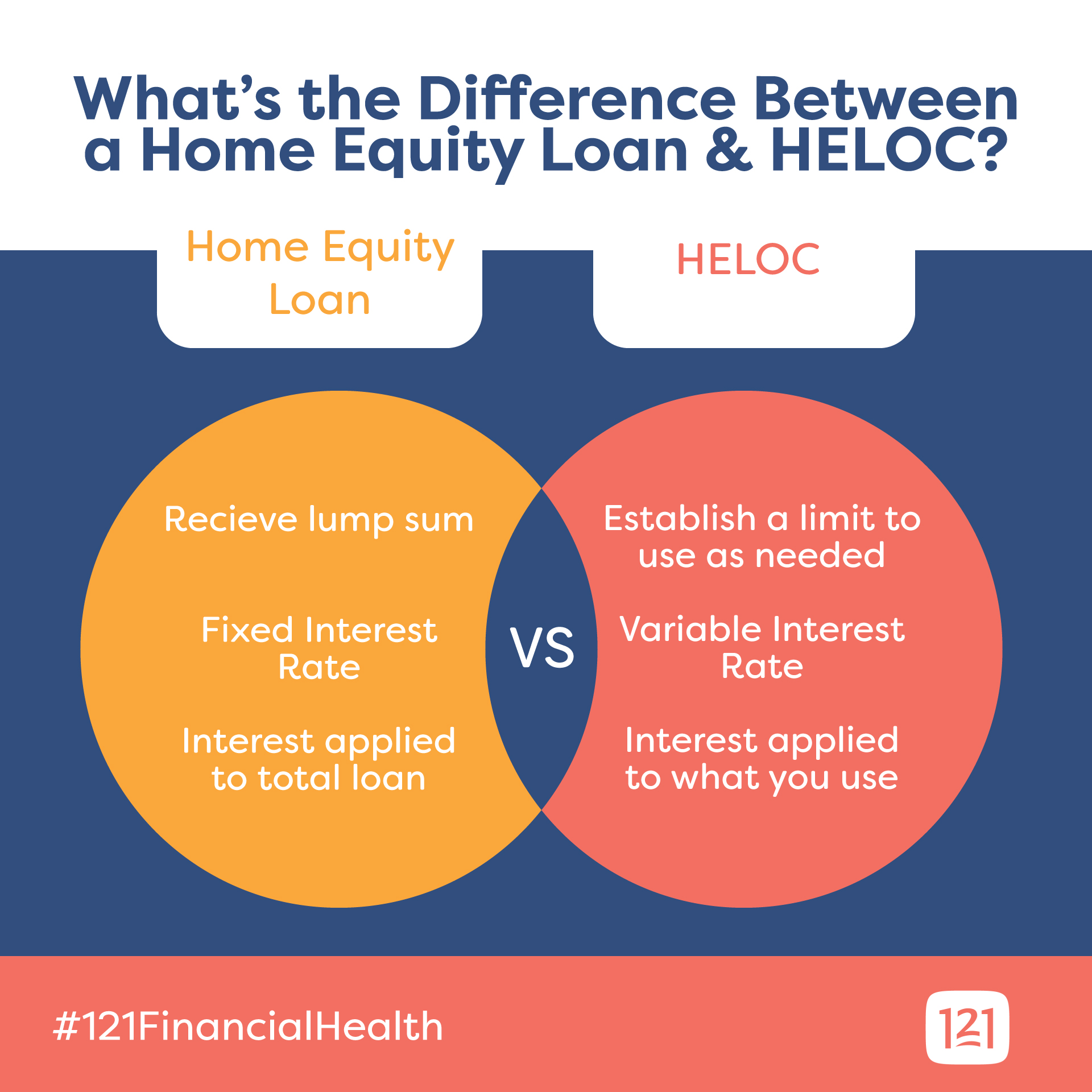

Web While the housing market is unlikely to crash in 2023 sellers should expect property values to creep downward. When you take out a HELOC you receive a maximum line of credit that you may. Web A home equity loan rather than a line of credit functions as a second mortgage because the money is distributed in a lump sum.

HECMs are only available to seniors 62 with. Web An open-end loan is set up as a line of credit with your lender. Credit card accounts home equity lines of credit HELOC and debit cards are all common examples of open.

Web HELOC rates vs. We have a HELOC program that has a 15 year open-end draw period and a 15 year. Web Another type of home loan is a home equity line of credit or a First Lien HELOC.

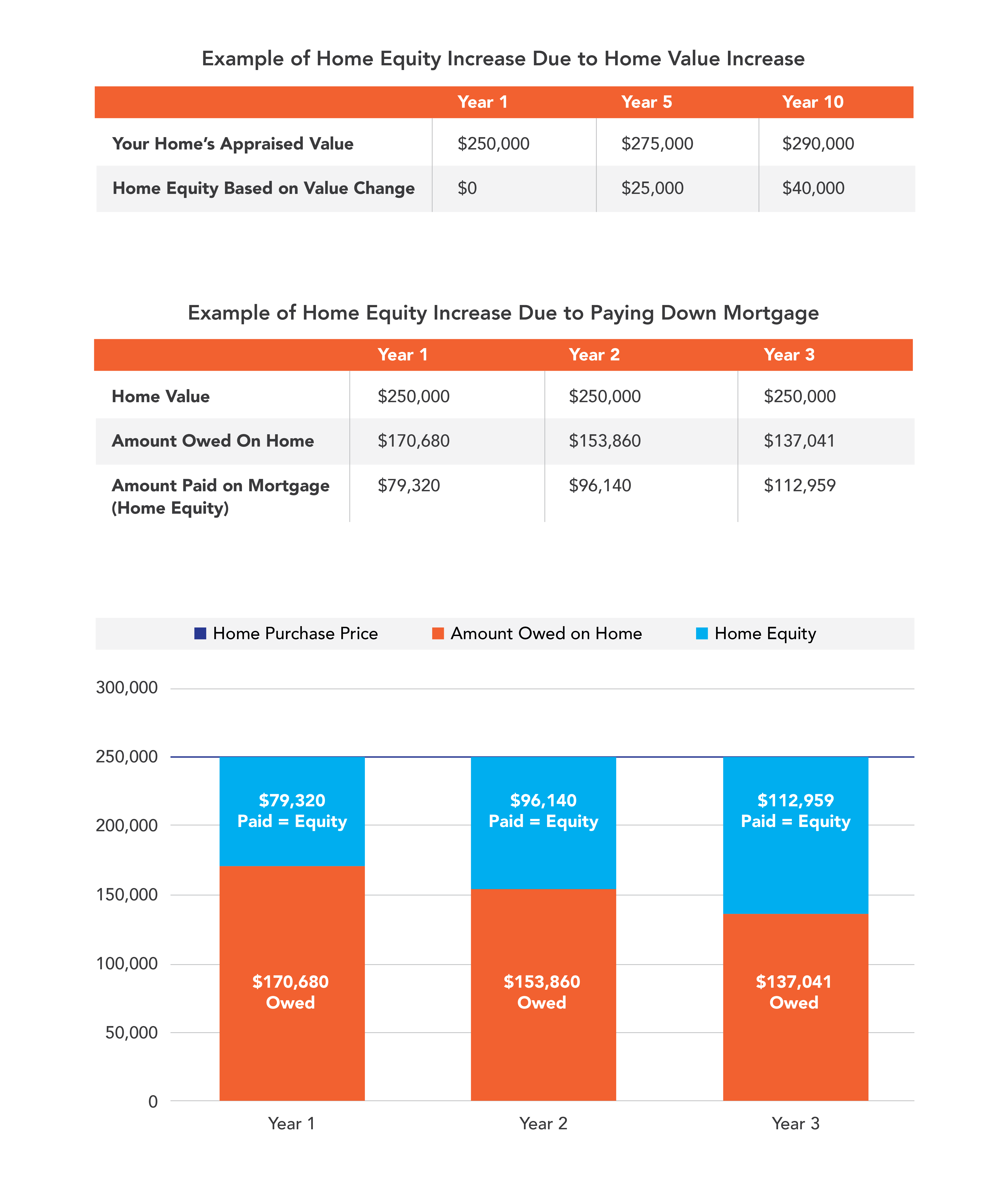

Web As mortgage rates rise homeowners can keep their current low interest rate home loans but still access the money tied up in their home. A home equity loan gives. Web An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related.

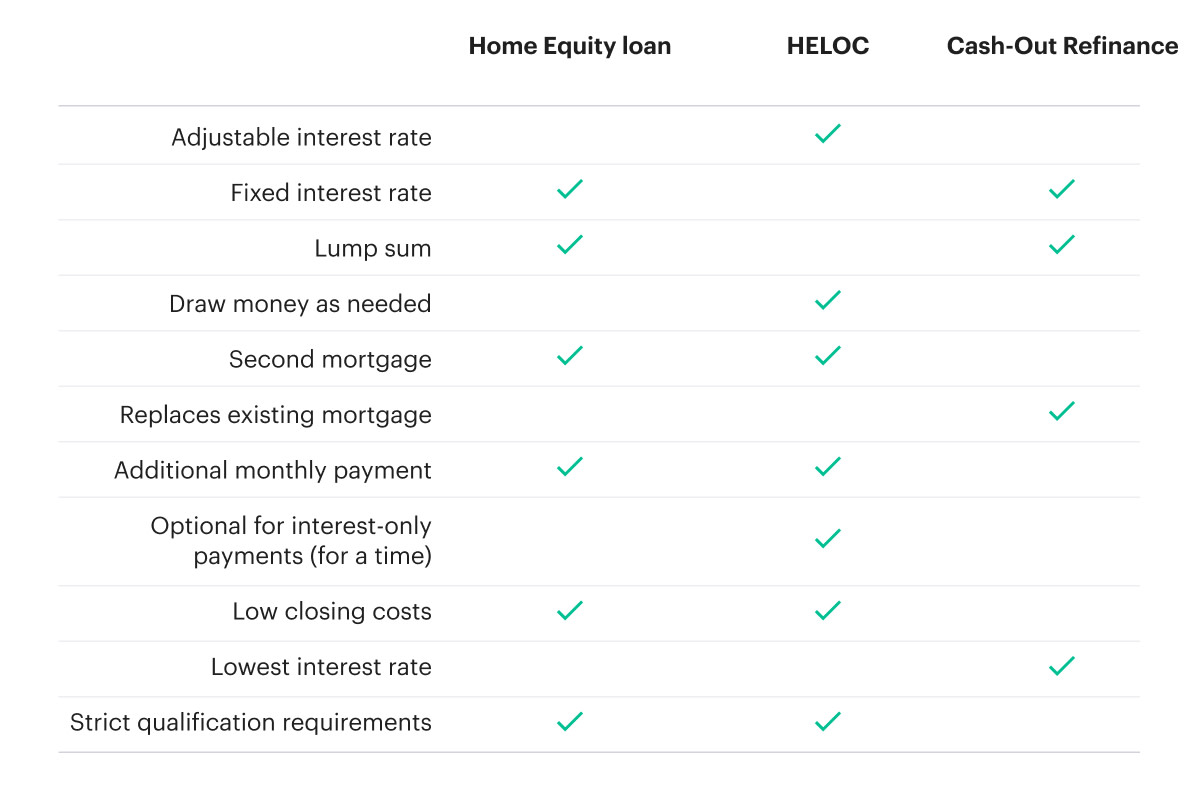

Web Borrowers who can check those boxes are the most likely to get approved for an open-end mortgage. For example using a standard mortgage you. Mortgage rates Typically mortgage rates are substantially lower than HELOC rates.

Web As you can see HECMs have no monthly mortgage payments while HELOCs require monthly payments. Web The open line of credit that can be made available with a HECM gives the homeowner significantly more borrowing power than a HELOC. While HELOC borrowers pay an.

Web Unlike a standard mortgage loan a HELOC is set up for a specified maximum draw not a fixed dollar amount. Payments are made in. To some it equates to a revolving line of credit but to others it is simply a type of security agreement.

How open-end loans work.

How Does The Mortgage Loan Process Work Rate Com

How Do Home Equity Loans Work And When To Use Them

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

Heloc Vs Line Of Credit Know The Differences

Home Equity Line Of Credit Heloc Vs Cash Out Refinance Nextadvisor With Time

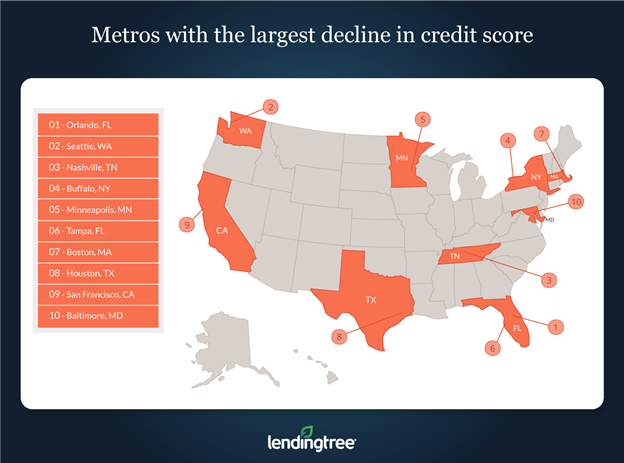

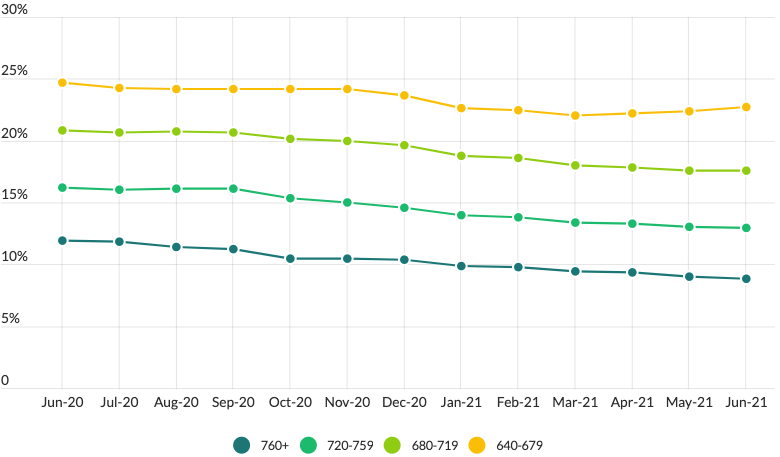

Study Home Equity Loans Have Minor Impact On Credit Scores Lendingtree

What Is A Heloc And How Does It Work Pandadoc Notary

Open End Loan Home Equity Line Of Credit Midflorida

Home Equity Vs Refinance Hel Heloc Refinance Better Mortgage

Home Equity Line Of Credit Heloc Midland States Bank

Home Equity Loans The Community Bank Zanesville Oh Cambridge Oh Newark Oh

Home Equity Loan Or Heloc Vs Cash Out Refinance Bankrate

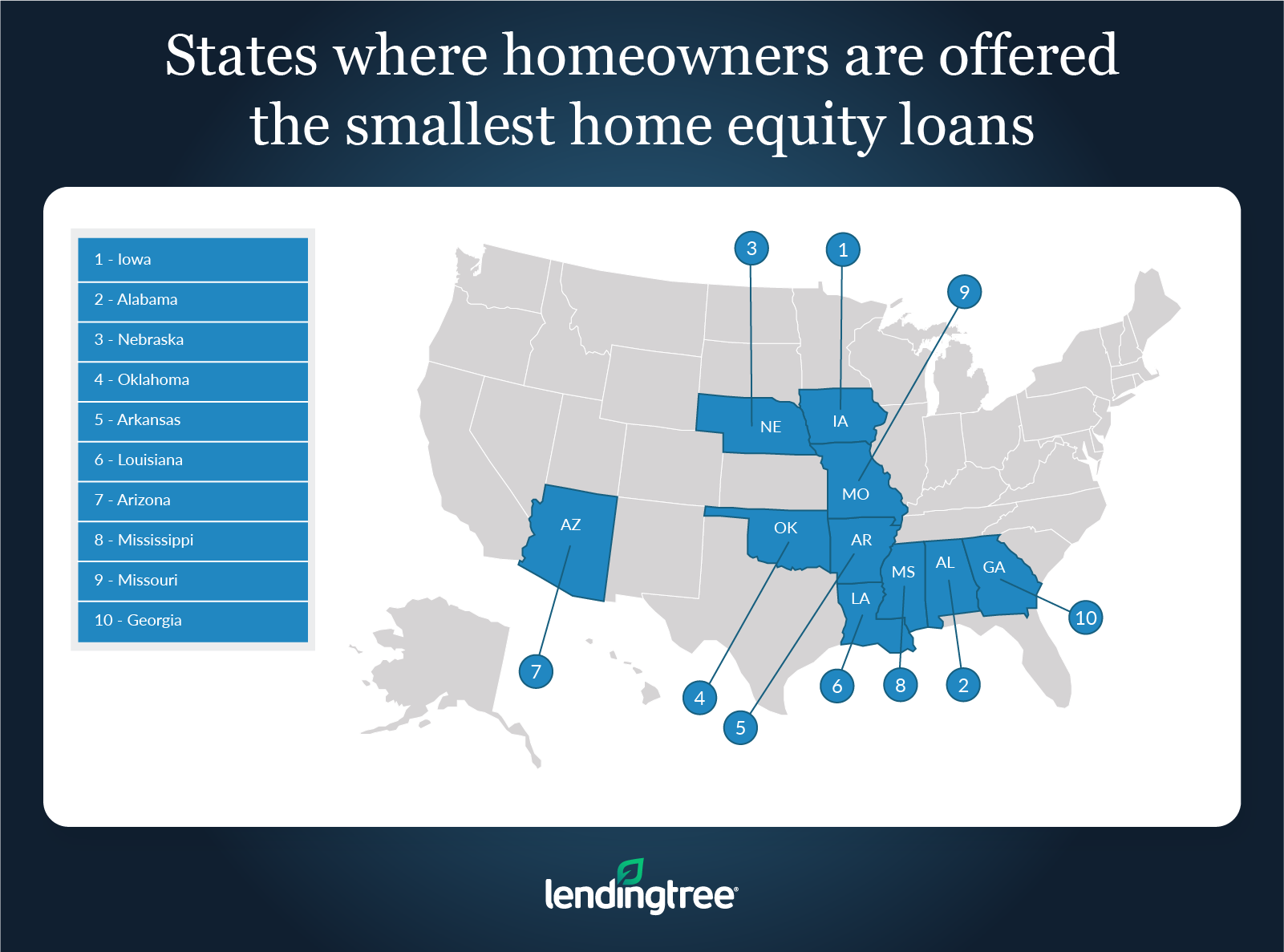

Study Largest Smallest Home Equity Loans Lendingtree

Home Equity Loan Versus Heloc Here S How To Decide

Home Equity Loan Vs Line Of Credit Cobalt Credit Union

Heloc Vs Home Equity Loan Which Is Right For You Forbes Advisor

Home Equity Loan Vs Personal Loan How They Compare

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau

:max_bytes(150000):strip_icc()/shutterstock_188743595.home.equity.loan.cropped-5bfc30d1c9e77c0026b5f52e.jpg)